CA Social Purpose Corporations – Annual Shareholder Report

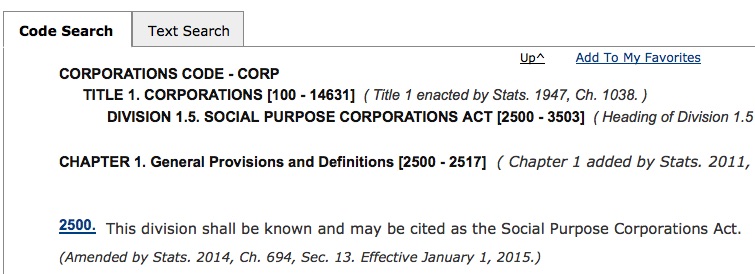

A California Social Purpose Corporation is formed pursuant to Corporations Code sections 2500 et seq.

Social Purpose Corporations are required to provide annual reports to shareholders no later than 120 days after the close of the corporation’s fiscal year.An outline of these requirements is provided below. Detailed requirements for this annual report are found in Corporations Code § 3500.

Financial Information —

The Social Purpose corporation must provide a balance sheet through the end of the fiscal year, including an income statement, statement of cash flows for the fiscal year, and any report by an independent accountant. If there is no accountant report, the corporation must provide a certificate by an authorized officer of the corporation that the financial statements were prepared without audit.

Special Purpose Management Discussion and Analysis —

The corporation must provide a Special Purpose Management Discussion and Analysis (MD&A) concerning the social purpose stated in its Articles of Incorporation. The MD&A must the information listed below. To the extent possible, and consistent with reasonable confidentiality requirements, the corporation shall post the MD&A on its website, or other social media. The MD&A must:

- Identify and discuss the overall objectives relating to the corporation’s social purpose, or any changes made in the special purpose objectives during the fiscal year.

- Identify and discuss material actions taken by the corporation during the fiscal year to achieve its stated social purpose.

- Identify and discuss the impact of corporate actions, including causal relationships between actions taken and reported outcomes, and the extent that the actions achieved the special purpose objectives for the fiscal year.

- Identify and discuss material actions, including the intended impacts, that the corporation expects to take in the short term, and long term, to achieve its special purposes.

- Describe the process for selecting, and identify and describe the financial, operating, and other measures used by the corporation during the fiscal year for evaluating its performance in achieving its special purpose objectives. Include an explanation of why the social purpose corporation selected those measures. Identify and describe the nature and rationale for any material changes in those measures made during the fiscal year.

- Identify and discuss any material operating and capital expenditures incurred by the corporation during the fiscal year to achieve the special purpose objectives.

- Provide a good faith estimate of any additional material operating or capital expenditures the social purpose corporation expects to incur over the next three fiscal years in order to achieve its special purpose objectives.

- Describe other material expenditures of resources incurred by the social purpose corporation during the fiscal year, including employee time, in furtherance of achieving the special purpose objectives.

- Include a discussion of the extent to which that capital or use of other resources serves purposes other than and in addition to furthering the achievement of the special purpose objectives.

All information contained herein is provided for general informational purposes only. The information provided is not legal advice, and is not to be acted on as such, may not be current, and is subject to change without notice.